Last Updated on 11. June 2025 by mgm-marketing

For the insurance industry, artificial intelligence (AI) offers tremendous potential for differentiation in customer engagement and internal efficiency. However, many Chief Information Officers already have a full to-do list, as the top priority of “digitizing the business” is often still in its infancy. The challenge now is to bring AI to the operational level as a second game changer. Can the two go together?

Anyone who follows the relevant business media and specialized services for Chief Information Officers knows that the productive use of artificial intelligence is already a proven tool in industry. Companies in a wide range of industries are recognizing the efficiency potential of AI technologies, evaluating them and, if the business case is promising, implementing them.

The use of AI has already caused a stir in the insurance and financial sectors. A recent example is the development of the HDI-GPT” AI application. This is HDI’s internal generative AI for optimizing insurance processes and workflows. By processing data from various sources, HDI-GPT can support employees in handling individual use cases. The AI application runs in private cloud instances to meet regulatory requirements and ensure data processing security and compliance.

Estimating potential value at the use case level

Another example is the use of an AI agent in the global customer service department of Klarna, a financial services company. According to Klarna, this agent handles two-thirds of all customer service chats, which is equivalent to the work of 700 full-time employees. Through this automation, Klarna aims to save $40 million (€37 million) annually, while reducing the time it takes to resolve customer issues from eleven to two minutes. Klarna is using OpenAI-based solutions for the implementation.

These two examples alone make it clear that the introduction of AI in the insurance industry can help not only to optimize internal processes and save costs, but also to improve the customer experience. We are currently seeing many ideas being prioritized at the departmental level. One of the tasks now is to estimate the expected value contribution of the identified use cases. Together with the management, a unified decision basis for the company-wide introduction of proof of concepts (PoC) can be found, so that the scaling phase can begin. This sounds simple, but it is often not the reality in the enterprise.

Connecting internal systems with AI-based solutions – the more, the better

For example, if AI is used to read large data attachments such as annual reports, risk reports, financial data, and fleet or portfolio data in emails during the commercial or industrial quotation process, this already achieves an initial efficiency gain. The processing time for reading the documents and clarifying any questions can be greatly reduced.

If, in the next step, this data is used, for example, to complete the quotation or underwriting process in a digitized system, this opens up new possibilities:

- a fully automated data check and, if necessary, even a quote, or

- Automatic generation of queries such as “We are still missing the desired deductibles and the last annual profit.

Measurements we conducted at an insurance company to estimate the value contribution for the SME commercial business showed a balanced distribution in this specific case: about half of the effect was realized through the reduction of quotation processing times, and the other half through the expected process automation in conjunction with a digital quotation system.

Can AI work without modern digital management systems?

But can AI make business processes more efficient even if they cannot be easily connected to modern interface-based integration technologies via API (Application Programming Interface)? This question is often asked by companies that are tied to legacy systems.

The answer is yes. In recent years, many companies have gained experience with so-called robotics solutions, which act as an interface technology between different systems. Robotic technology – like any other employee – is given the ability to read data from one source system and feed it into another system for further processing. This experience can also be used to deploy AI-based solutions in conjunction with non-digital management systems.

However, this increases the cost of implementation. This means that the use cases have to generate a higher value contribution in order to be as profitable as solutions without the use of robotics. However, companies are wasting no time in gaining initial experience with AI and taking their existing systems into account. At the same time, companies that will continue to operate their legacy systems for another five to ten years have the opportunity to at least do so more efficiently and thus expand their scope somewhat.

Starter Kit and Model Selection: Building a Secure and Trusted AI Infrastructure

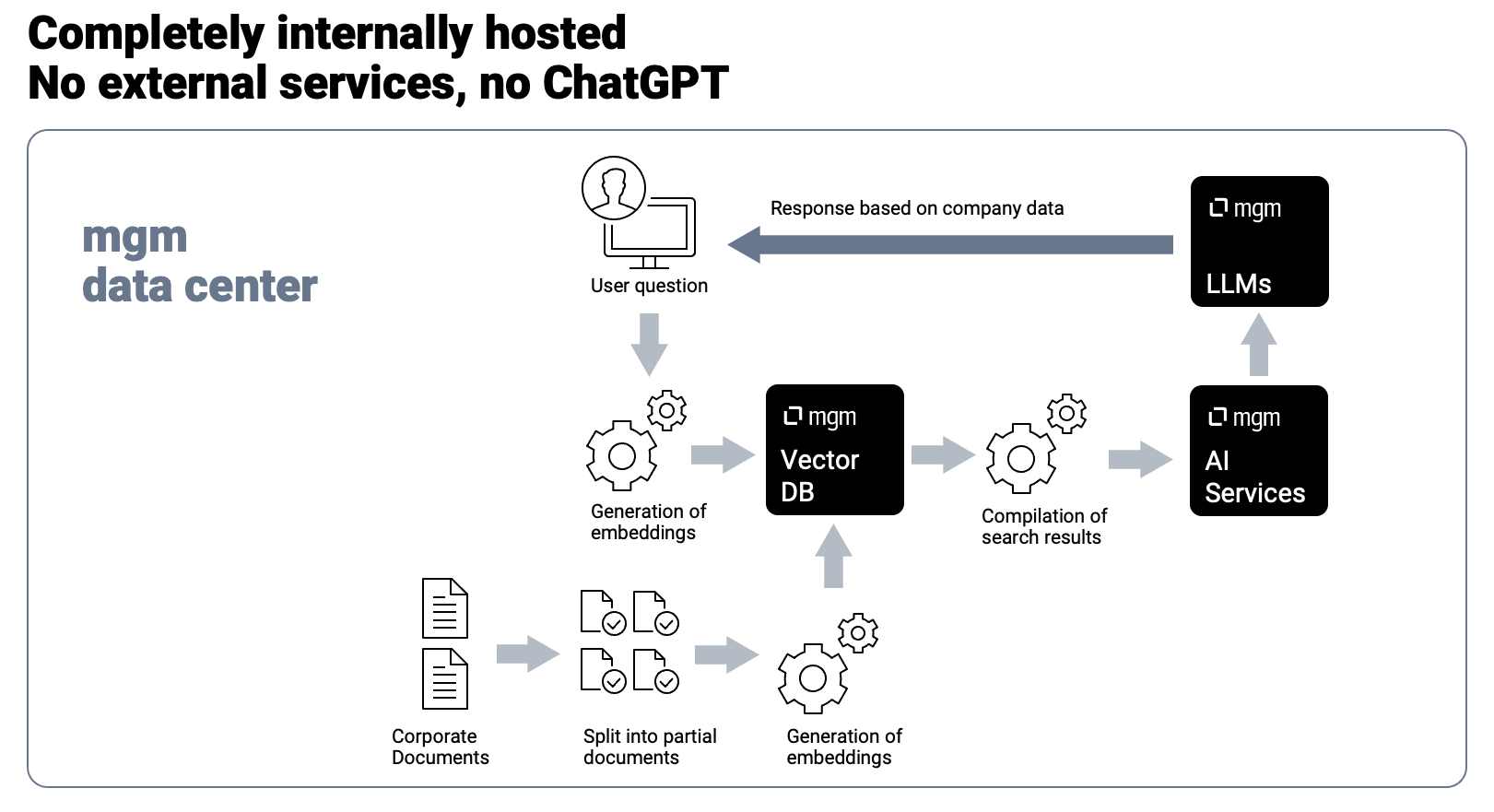

No AI application without hardware, computing power and the right software. Building a robust AI infrastructure is a fundamental step for industrial insurers and brokers in a regulated market. They need to decide whether to run AI applications on-premises – on local computers – in the cloud, or in a hybrid environment. Each of these options has its own advantages and disadvantages in terms of scalability, cost, and security.

Flexible Infrastructure for Models and Old and New Digital Projects

Based on past experience, it makes sense to invest in an infrastructure that can support multiple models. This strategy also makes sense if, for various reasons, not all conceivable and future models can go into production. For example, experience shows that sample data is available during the PoC phases, but cannot be used in a completely secure environment. However, knowledge of what works and how models evolve should not be limited by a focus on one or two models. To work effectively with multiple models in different environments, there are also test data generation systems.

Granted: Because the industrial insurance sector is still heavily characterized by non-digital solutions, the potential added value of AI solutions is often limited. But where resources in the form of money and personnel are already flowing into urgently needed digitization processes, the new topic of AI should be directly linked to them. It may therefore be advisable for companies to balance and prioritize their budgets between the two “winning topics”.

This text was first published in July 2024 as a guest article in the German-language “Herbert Frommes VERSICHERUNGSMONITOR” (fee-based), here is the teaser on the website.